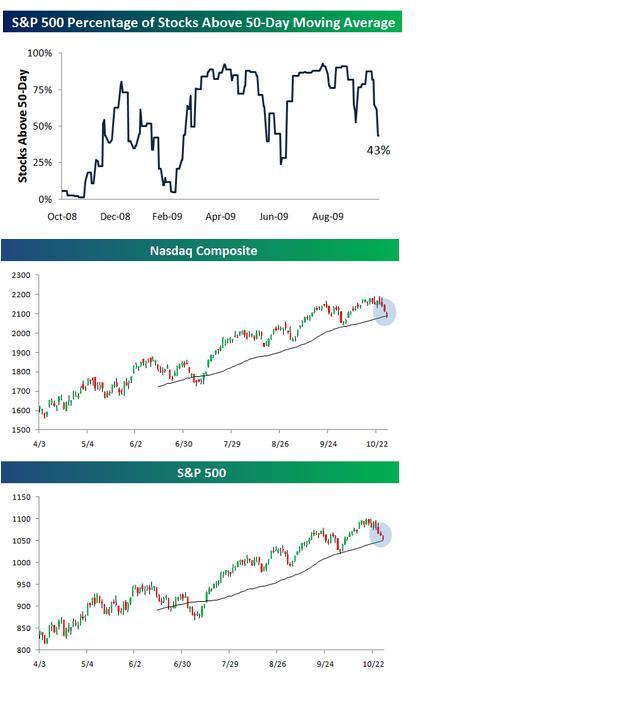

・50日線を上回っている銘柄数が激減しているという話。

とくに素材・金融・テクノロジーの落ち込みが激しいと、、、

Percentage of Stocks Above 50-Day Moving Averages Falls Sharply

Only 43% of stocks in the S&P 500 are trading above their 50-day moving averages at the moment, which is below the low we saw at the end of September. The percentage isn't as low as it got during the July correction, but another day like today, and it no doubt will be.

The percentage of stocks above their 50-days in the Materials sector has fallen the most, from nearly 100% above all the way down to just 17%. Financials and Technology have taken big hits as well. Energy and Consumer Staples both still have more than 70% of stocks above their 50-days, so they've held up the best on the recent declines.

・ナスダックも7月以降初めて50日線を下回る。

SP500も50日線をテスト中。

Nasdaq Breaks 50-DMA, S&P on the Brink

While the Dow is down just 50 points at the moment, both the S&P 500 and the Nasdaq are quietly down more than one percent. As shown in the first chart below, the Nasdaq just broke below its 50-day moving average for the first time since July, which means its multi-month uptrend is in big jeopardy. The S&P 500 is currently testing support at its 50-DMA, and the bulls are desperately hoping that it holds. The same thing happened for the S&P at the end of September, and the bulls prevailed. We'll see how it plays out this time around, but things definitely look a lot different now than they did just a couple weeks ago. The S&P's 50-day is right above 1,050, so that is the level to watch for the remainder of the day.

- 重要なお知らせ 一覧