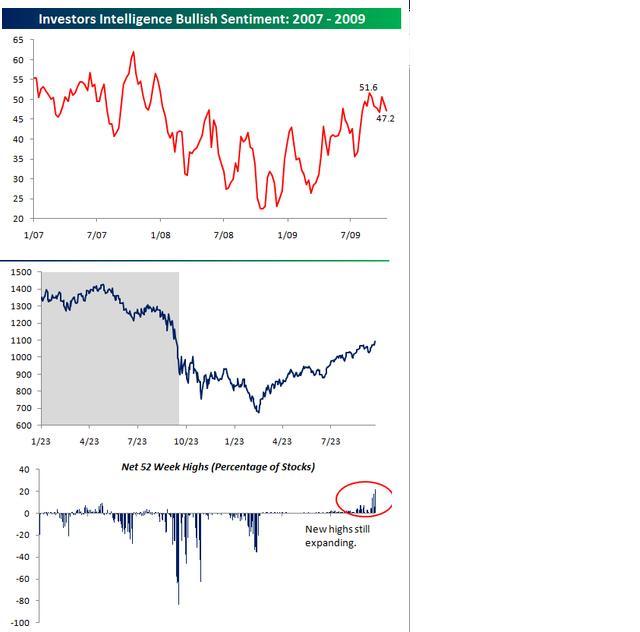

・投資家センチメントは上昇してるみたいだけど、それでもまだ50以下(ってことは若干弱気が多いのかな???)2007年のピーク時と比べるとまだ上昇余地あり???(画像1上図)

Bullish Sentiment High But Still Below 50%

With the Dow up more than 50% since its lows in March, it is no surprise that sentiment among newsletter writers has improved dramatically. As shown below, the percentage of bullish newsletter writers has increased from a low of 22.4% in October 2008 to 47.2% today. While sentiment has improved, we would note that some investors are still uneasy. With bullish sentiment below 50%, this implies that over half of newsletter writers are anticipating a bear market or at least a 10% correction. Additionally, even as the major indices have all hit new highs off the lows, bullish sentiment is down from its peak of 51.6% in late August and at its lowest levels since the first week of August.

・高値更新銘柄が広がってるみたい(画像1下図)

This is a bull market that's lifting all boats. With today's run above 10,000 in the DJIA, and another new high in the S&P 500, the number of stocks in the S&P 500 hitting 52-week highs rose to 22% (110 stocks). As long as this figure can expand as the market rises, the ball is in the bulls' court.

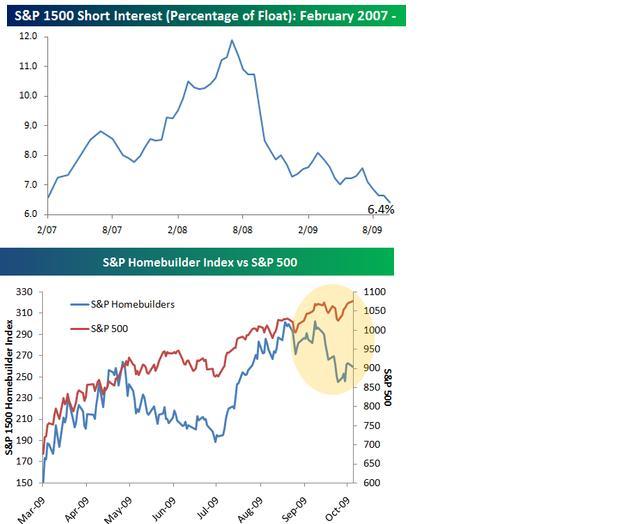

・でも住宅業者株は伸び悩みみたい。ダウが高値更新するも取り残されてるみたいです。(画像2下図)

Homebuilders Fail To Make New Highs

Dow Theory followers have noted recently that the Dow Transports index has failed to confirm the market's uptrend since it isn't at new highs while the Dow Industrial Average is. But maybe a more worrisome trend this time around is that the S&P 1500 Homebuilder Index has failed to make new highs along with the overall market. Since the homebuilders led the market lower during the bear and were some of the best performers out of the gate at the start of the bull, this group may be the important one to watch for confirmation of the rally. As shown below, the homebuilder index has really struggled in recent weeks and is still well below its bull market peak while the S&P 500 closed at a new high yesterday. The bulls are hoping that this divergence is just normal sector rotation that occurs throughout the market cycle, but the bears could argue that this is a sign that the rally is running thin.

・空売り比率が減ってるって話(画像2上図)

Short Interest Declines Again

Last Friday, short interest figures for the end of September were released, and once again they showed declines. The average short interest as a percentage of float for companies in the S&P 1500 was 6.4%. This is now lower than any other point since at least the start of 2007. As shown in the chart, bets against the market have declined considerably since their peaks in 2008.

As if shorting into one of the strongest rallies ever hasn't been hard enough, now traders on the short side have to deal with 'merger Mondays'. A case in point recently was Affiliated Computer Services (ACS). During the second half of September, ACS saw a larger increase in short interest than any other stock in the S&P 500 relative to its range of the last year. In absolute terms, its short interest increased by over 200% from 1.3 mln to 4.2 mln shares. Since short interest figures are calculated using settled trades, and settlement for equities is three trading days, under normal circumstances the last day to trade ACS in order to be included in the September figures would have been on Friday September 25th.

So what happened the next day? Before the opening on 9/28, Xerox (XRX) announced that it was buying ACS for $63 in cash and stock. After closing the prior Friday at $47.25, ACS traded 14% higher on Monday. Just as 2008 was probably the golden age of shorting, the last two quarters have been the dark ages.

・S&P500種、海外投資家にはかつてないほど割安な水準-ドル安で

http://www.bloomberg.co.jp/apps/news?pid=90920021&sid=aDUEnkOodAPE

もしかして。。。ダウがおつおいのは、外人(アメリカ人以外)が買ってるから???

ドル安で相対的に安くなったアメリカ株を買ってるのか、、、

- 重要なお知らせ 一覧